The Basics | Salary Ranges

Not every church leader is familiar with HR terms and concepts. ChurchSalary is here to help.

Summary

Salaries are distributed across a range. This salary range is measured and reported using quartiles or percentiles. The range between these data points can be calculated as a salary spread (e.g., 50 percent). After performing market research utilizing resources like ChurchSalary, your church can calculate a new salary range using a localized or adjusted midpoint and an industry-standard human resources (HR) formula.

What is a salary range?

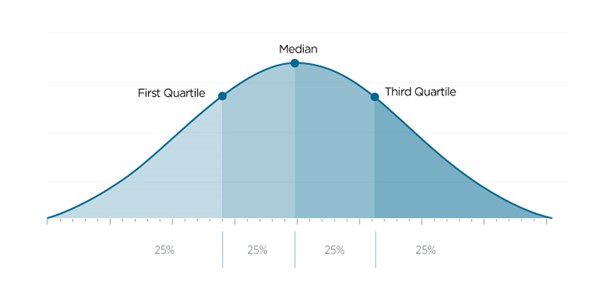

Salaries in the real world, when sampled within different professions, fall along a continuum. When plotted, their range (or distribution) looks like a bell curve. Some salaries will be higher than the midpoint and some will be lower; however, the majority of salaries will be clustered together in the middle. This is called a normal distribution and is shaped like a bell—hence the name.

Salary distribution is reported using several data points. Every ChurchSalary report quantifies this range using the first quartile, median, and third quartile. Some reports also provide the 10th and 90th percentile numbers, but these are not as useful in church settings for reasons we’ll discuss below.

These three points capture the distribution of salaries and divide the entire range into four segments of equal size—hence the term “quartile.”

The median is the middle point of the data set: 50% of salaries fall above or below this number. The first and third quartiles divide the data set at the 25% and 75% marks. For that reason, they are sometimes called the 25th percentile and 75th percentile, respectively. Ultimately, 75% of salaries will fall either above or below the first and third quartiles and the majority (50%) will fall between them.

Where do salary ranges begin and end?

ChurchSalary recommends that churches use the first quartile and third quartile numbers as a foundation for their salary ranges. Employees with less experience and minimum qualifications may start out at the bottom of this range, while those with more experience, better qualifications, and a track record of success may start higher (or move higher over time).

We recommend that churches use these two values instead of the 10th percentile and 90th percentile for several reasons. One crucial reason is tied to the third quartile and the Internal Revenue Service (IRS).

In order to maintain their tax-exempt status, churches must not pay unreasonably high compensation to pastors or staff. Otherwise, they jeopardize their tax exemptions, and they also subject their employees, as well as the key decision-makers who approve compensation, to potentially substantial taxes, interest, and penalties from the IRS.

Neither the courts nor the IRS have pinpointed what precisely qualifies as unreasonable compensation. However, the IRS uses outside salary surveys to determine when an individual’s compensation is unreasonable. For that reason, when an employee’s salary will exceed the 75th percentile churches are strongly encouraged to consult with qualified legal counsel. As part of their salary review process, we recommend churches use comparable outside data offered through ChurchSalary, involve independent decision-makers in the approval of compensation, and fully document the process, including all supporting information. (To learn more about the steps needed to avoid unreasonable compensation, check out CPA Elaine Sommerville’s Church Compensation, Second Edition, from Church Law & Tax.)

This is also one of the reasons why ChurchSalary does not currently provide 10th percentile and 90th percentile numbers in our reports. Those who are more familiar with HR practices and tax laws related to compensation may choose to use these numbers, but we encourage churches to aim for the middle 50 percent—between the first quartile and third quartile.

Calculating salary spread

After conducting an in-depth salary review, churches may wind up with a localized average or an adjusted midpoint. This new midpoint can be used to calculate a salary range with the help of an industry-standard HR formula.

This formula uses a “salary spread” percentage to produce new first- and third-quartile values. Changing the spread increases or decreases the calculated range (distribution) based on a static midpoint, as you can see in this chart below.

These minimum and maximum values roughly correspond to the 10th and 90th percentiles. We include them because they are a necessary step in the calculation.

Salaries within each profession are spread out differently in the real world. Typically, leadership salaries are more spread out, while administrative and hourly positions are clustered closer together. The Economic Research Institute (ERI) and several other HR organizations use the following salary spread percentages to calculate adjusted salary ranges:

- Administrative/Operations: 40% +

- Professional/Management: 50% +

- Executives: 50-65% +

The formula for calculating an adjusted salary range is fairly simple. All you need is a midpoint and a salary spread:

- Minimum = Midpoint / 1 + (½ of Salary Spread)

- 1st Quartile = (Minimum + Midpoint) / 2

- 3rd Quartile = (Maximum + Midpoint) / 2

- Maximum = Minimum x (1 + Salary Spread)

Start by calculating the minimum and maximum values. Then, use those values to calculate the first and third quartiles for your adjusted salary range.

Play around with this formula and generate new salary ranges using this free Excel spreadsheet from ChurchSalary.

This content is designed to provide accurate and authoritative information in regard to the subject matter covered. It is published with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional service. If legal advice or other expert assistance is required, the services of a competent professional person should be sought. "From a Declaration of Principles jointly adopted by a Committee of the American Bar Association and a Committee of Publishers and Associations."

Due to the nature of the U.S. legal system, laws and regulations constantly change. The editors encourage readers to carefully search the site for all content related to the topic of interest and consult qualified local counsel to verify the status of specific statutes, laws, regulations, and precedential court holdings.