The biggest question we hear at ChurchSalary sounds simple but it’s actually pretty hard to answer: What should we pay pastors at our church?

It is tempting to just ask around: How much are pastors being paid down the road? But, this isn’t actually the best way to localize salary.

Why is localization important?

Churches in the same town will inevitably pay their staff differently for one simple reason: their budgets are different. Pastors get paid based on how much money is in the budget. That means the church next door or down the road isn’t always your best guide for setting salaries.

And yet, churches with identical budgets and attendance numbers may pay their pastors differently because it costs more to live in downtown Chicago than rural Kansas.

To account for these localization problems, our updated Salary Calculator now has the power to sift through millions of possible combinations to find the closest possible match to your pastor at your church.

Only ChurchSalary offers this powerful and ground-breaking localization tool for church compensation.

Why not just localize using COLI?

Before we explain the Localized Salary Recommendation section (LSR), let’s pause and talk about what it is not doing—and what you shouldn’t do either—to localize salary data.

In a nutshell, ChurchSalary is not artifically inflating or messing with the underlying data. The numbers in your report are not multiplied by a cost-of-living index (COLI) or adjusted based on median income. Salary doesn’t necessarily scale that way in the real world. That is why every number in these tables is based on the real salaries of real pastors, serving in communities just like yours.

Pro tip: You may need to apply an additional cost-of-living-adjustment or COLA to the figures in your salary reports. But we recommend that you base this COLA on differences in income as much as possible and not solely rely on cost of living indexes. For example, our article on How to Calculate a Cost-of-Living-Adjustment includes a county-level map of income differences. This helps quantify how much more or less actual employees earn in your area, on average, relative to the nation as a whole. And it may reveal that employees in your area are not earning enough to cover the higher cost of living. In other words, some areas of the country simply cannot (or should not) fully account for differences in the cost of living — either higher or lower. Instead, the finances for employees in these areas simply look different. They prioritize housing costs over other expenses—e.g., not owning a car in New York City or renting instead of owning.

How does the LSR work?

So, how does ChurchSalary’s localization tool work? Well, it’s complicated. But, basically we use your church’s zip code to generate a fingerprint of your community. This fingerprint is based on four variables:

1. Region

2. Cost of Living Index

3. Population Density

4. Median Household Income

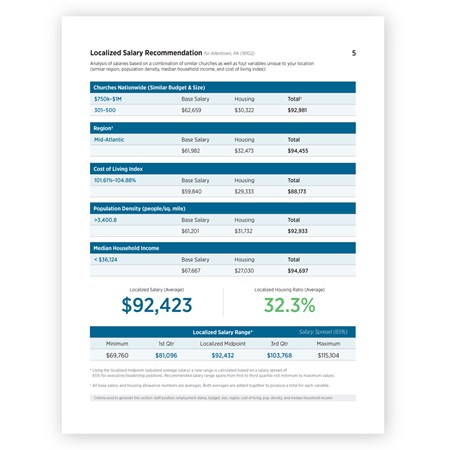

To understand better how this works, let’s walk through this powerful new section. Below is a screenshot from a sample report.

First, you’ll see at the top that all of this data is based on similar pastors serving at “similar churches.” In this case, the similarity is at the level of demographic variables.

Second, you’ll see five tables.

- Churches Nationwide (Similar Budget & Size)

- Region

- Cost of Living Index

- Population Density (people/sq. mile)

- Median Household Income

The first table is showing you a different perspective on data from the first section—the Nationwide Salary Summary. Rather than a median, all of these numbers are averages. That means, that this national average will be different than the median in the first section.

Each of the four variables contains the same breakdown of salary/compensation. These averages shows you how base salary and housing allowance vary depending on these different factors.

The second table shows you average salary data for pastors serving at similar churches in your region. ChurchSalary uses the Bureau of Labor Statistics regions because that is how the larger secular marketplace tracks salary. Bear in mind that this is a broad snapshot and your region may include a bunch of states. The region where ChurchSalary and Christianity Today are headquartered, in the Midwest, contains 10 different states.

The third table shows you average salary data for pastors serving in a community with a similar cost-of-living index.

As you can see from the map below, population density is a crucial variable. People in the US tend to be clustered around cities, and within these cities density varies greatly. In the fourth and fifth tables, you will find average salary data based on population density as well as median household income.

Creating a localized salary average

Our system looks at all of these variables, taking into account the nationwide data, in order to find the closest possible matches in our database. The system then uses these matches to produce a weighted Localized Salary Recommendation for your pastor at your church. This appears in the form of a localized salary average (which includes base salary and housing) and a housing allowance ratio average.

At the bottom of this section is a Localized Salary Range table. This adjusted range is calculated using an industry-standard HR formula.

Use these ChurchSalary resources to learn more about how this range is calculated:

- Read: The Basics | Salary Ranges

- Download: [FREE] Salary Spread Calculator

In a nutshell, though, ChurchSalary is using the localized average or midpoint (in the middle of the page) to calculate an adjusted salary range based on a common salary spread ratio.

Using these numbers to tune the salary range

If you compare this Localized Salary Range with the figures in the Nationwide Salary Summary, you’ll see that these values are similar but not the same.

At ChurchSalary, we recommend that compensation for the average employee should fall between the first and third quartiles. The minimum and maximum correspond, roughly, to the 10th and 90th percentile.

- If compensation at your church needs to compete with candidates at the national level, we recommend that you use the numbers in the Nationwide Salary Summary section.

- If you are more concerned about your local marketplace and cost of living, use this Localized Salary Recommendation as a guide.

Summary

Every ChurchSalary report is designed to walk you through three basic steps:

- Set the range

- Tune the range (based on your location)

- Place the employee within the range

The data in this section is designed to help you with the second step. Learn more about this three-step process in our How to Use Your Report video.

Take some time to analyze how salary differs depending on these variables and consider how that might impact salaries at your church. Perhaps population density is a big factor driving salaries in your area. To learn more about how to calculate a custom cost of living adjustment, using the numbers in this section and other data, consult our article on How to Adjust Salaries Based on Location.

Also, bear in mind that comparing these numbers with nationwide data in the first section may yield some valuable insights about how your church and your location is unique.

To learn more about ChurchSalary’s reports, check out the rest the videos in our Understanding Your Salary Report series.

Thank you for choosing ChurchSalary. If you haven’t already consider taking our National Church Compensation Survey, especially if your church is handling things like compensation factors well. We want to hear about it. Together, we can help more churches.